All Categories

Featured

Table of Contents

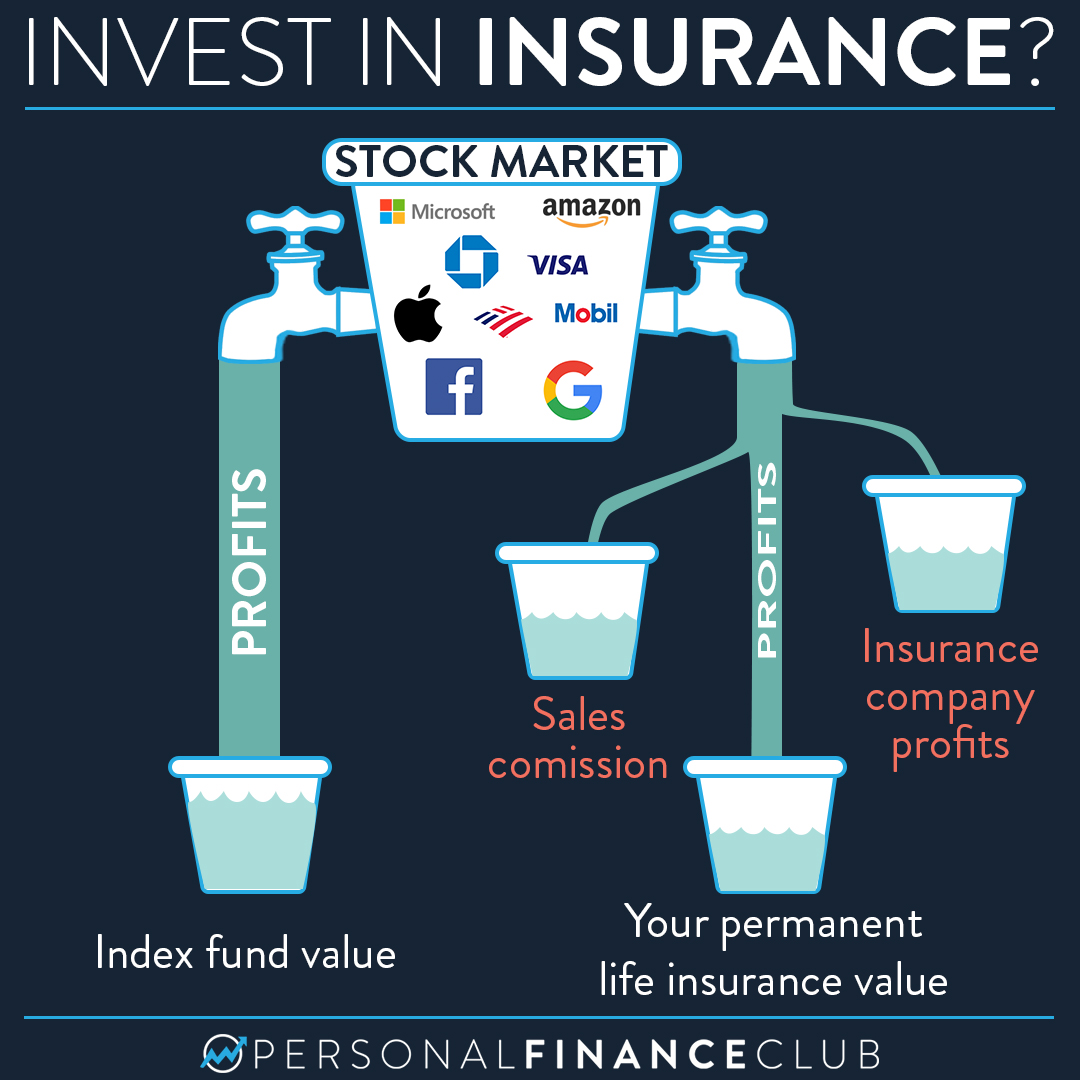

Indexed global life plans use a minimum surefire interest price, additionally known as a passion crediting floor, which decreases market losses. Say your cash money value loses 8%.

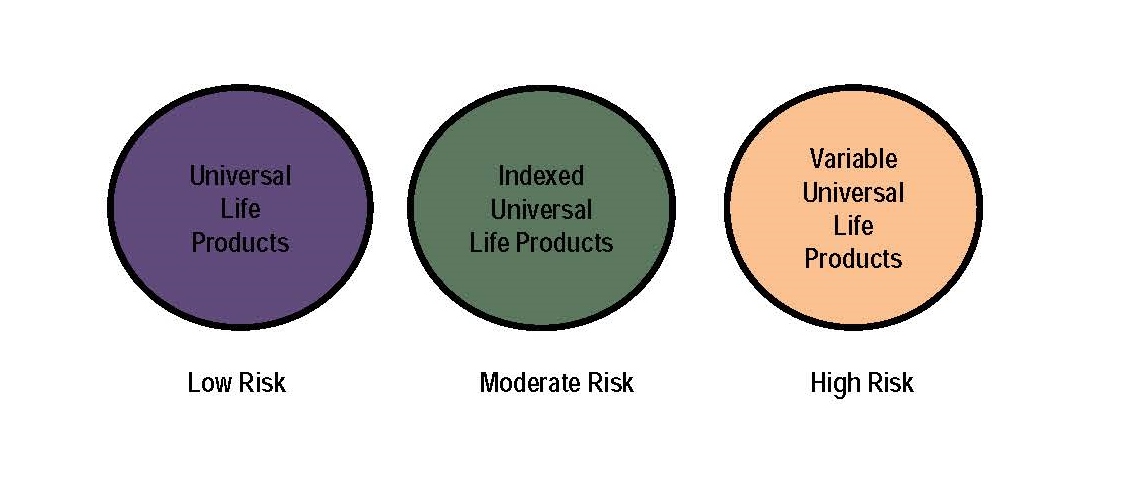

It's likewise best for those prepared to think added threat for greater returns. A IUL is an irreversible life insurance coverage policy that borrows from the homes of an universal life insurance policy policy. Like global life, it permits adaptability in your fatality benefit and premium settlements. Unlike global life, your money worth expands based on the efficiency of market indexes such as the S&P 500 or Nasdaq.

What makes IUL various from other policies is that a section of the superior payment goes right into yearly renewable-term life insurance. Term life insurance policy, also understood as pure life insurance, warranties fatality benefit payment.

An IUL policy may be the appropriate selection for a customer if they are looking for a lifelong insurance policy item that develops wide range over the life insurance term. This is because it uses potential for development and additionally preserves one of the most value in an unsteady market. For those that have significant properties or wide range in up front financial investments, IUL insurance coverage will be a terrific wide range management device, especially if someone desires a tax-free retirement.

Indexed Universal Life Vs Whole Life

The rate of return on the policy's cash value fluctuates with the index's motion. In comparison to various other policies like variable global life insurance, it is less dangerous. Motivate clients to have a discussion with their insurance agent about the ideal option for their conditions. When it concerns caring for recipients and managing wide range, here are some of the top factors that a person might choose to choose an IUL insurance coverage: The money worth that can build up due to the interest paid does not count towards earnings.

This means a client can use their insurance coverage payout as opposed to dipping into their social security cash prior to they are prepared to do so. Each policy needs to be tailored to the client's personal requirements, especially if they are managing substantial assets. The insurance policy holder and the representative can choose the quantity of threat they consider to be suitable for their needs.

IUL is a total conveniently flexible strategy. Due to the rates of interest of universal life insurance policy plans, the price of return that a client can possibly obtain is greater than other insurance policy coverage. This is because the proprietor and the agent can leverage call choices to raise possible returns.

What is the best Iul Calculator option?

Insurance holders might be attracted to an IUL policy due to the fact that they do not pay capital gains on the extra cash money value of the insurance plan. This can be contrasted to various other plans that require tax obligations be paid on any type of cash that is taken out. This indicates there's a money asset that can be secured any time, and the life insurance coverage policyholder would certainly not have to stress over paying taxes on the withdrawal.

While there are several advantages for an insurance policy holder to select this type of life insurance, it's not for everybody. It is necessary to allow the consumer recognize both sides of the coin. Below are some of the most important points to motivate a customer to think about prior to going with this selection: There are caps on the returns a policyholder can receive.

The very best choice depends upon the customer's threat resistance - Indexed Universal Life account value. While the charges linked with an IUL insurance plan are worth it for some customers, it is very important to be upfront with them concerning the expenses. There are premium expenditure charges and various other management fees that can begin to add up

No ensured passion rateSome other insurance policy policies use a passion rate that is guaranteed. This is not the situation for IUL insurance.

What are the benefits of Indexed Universal Life Interest Crediting?

It's crediting price is based on the performance of a supply index with a cap rate (i.e. 10%), a floor (i.e.

8 Permanent life irreversible consists insurance policy is composed types: kinds life and universal life. Cash value grows in a taking part whole life policy through dividends, which are proclaimed yearly by the company's board of directors and are not ensured. Money value expands in a global life plan through attributed rate of interest and lowered insurance policy costs.

How can Indexed Universal Life Financial Security protect my family?

No matter how well you prepare for the future, there are occasions in life, both anticipated and unforeseen, that can influence the monetary health of you and your loved ones. That's a reason for life insurance coverage.

Points like possible tax obligation rises, inflation, financial emergency situations, and preparing for events like college, retirement, or perhaps wedding events. Some sorts of life insurance coverage can aid with these and various other problems also, such as indexed universal life insurance, or merely IUL. With IUL, your plan can be a funds, because it has the prospective to develop worth with time.

You can select to get indexed interest. An index may influence your rate of interest credited, you can not invest or straight participate in an index. Right here, your policy tracks, yet is not in fact invested in, an outside market index like the S&P 500 Index. This hypothetical instance is offered illustratory functions only.

Fees and expenditures may decrease plan worths. You can also select to get set passion, one set foreseeable rate of interest rate month after month, no issue the market.

How does Indexed Universal Life Policy work?

That leaves more in your plan to possibly keep expanding over time. Down the road, you can access any kind of offered money worth through plan loans or withdrawals.

Table of Contents

Latest Posts

Iul Online

Allianz Iul

Guaranteed Universal Life Insurance Cost

More

Latest Posts

Iul Online

Allianz Iul

Guaranteed Universal Life Insurance Cost